It’s a common occurrence out there on the road: you’re driving along, keeping a safe distance from the car ahead, and suddenly it hits the shoulder and hurls a stone at your windshield. When the sharp crack fades away, you notice a chip out of the glass, or even worse, a crack starting to spread across your field of vision. For many people, their next thoughts become about windshield insurance claim and if it will their car insurance premiums.

Am I covered for windshield insurance claims?

Good news: generally, your policy will cover chips and cracks in your windshield. If your auto insurance policy includes comprehensive coverage, your coverage should be air-tight. Comprehensive insurance covers damage to your vehicle that isn’t caused by a collision, and includes coverage for falling or flying objects—especially stones.

If your vehicle’s insurance policy does not include comprehensive coverage, then windshield damage may be your insurer’s prerogative. Our experience has been that most insurers in Canada will honour this kind of claim on good faith, as long as it doesn’t happen often.

Windshield replacements may only cost between $160-$300 for older cars, but replacing one on a newer car could set you back as much as $2,500 on newer cars. Incorporating all of the technical calibrations for sensors and safety cameras can become expensive, both for replacement parts and for the labour needed to install them. Fancy cars come with higher repair costs in general.

What should I do if my windshield is chipped?

If your car’s windshield is chipped, then you should go to a windshield repair company as quickly as possible—it’s still usually way cheaper to fix a windshield than to replace one, even if you don’t have the coverage on your policy.

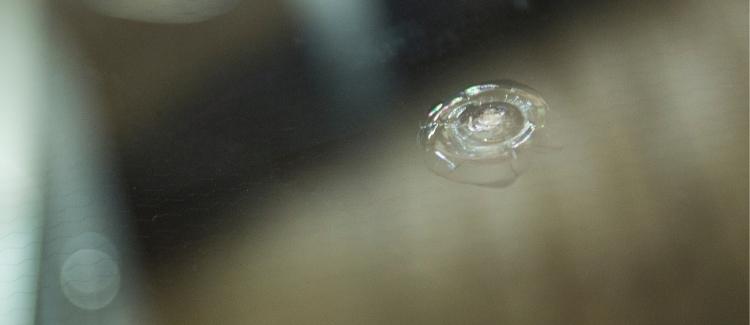

Repairing a chip costs a fraction of the expense of replacing the whole windshield. Glass repair technology is surprisingly effective, and the repair facilities can often repair chips that are large or strangely shaped. Even small cracks can be repaired, but if it becomes bigger than a quarter, then your windshield has a much bigger chance of getting worse. Just take this as a general guideline rather than a hard and fast rule, though!

Because the cost to repair chips is so much cheaper than the cost to replace a windshield, many insurance companies will not ask you to pay a deductible if you have this process done, eliminating your expenses. Not bad, right?

A possible exception to that rule might apply for commercial drivers covered by Uber’s insurance. It’s up to your insurer (and they’ll tell you if you’re covered if you ask!), but windshield repairs and replacements generally apply to personal auto policies. That’s because it’s understood that personal policies cover commutes for work, personal errands like shopping for groceries, and social visits. There’s only so much risk to cover on a personal policy, but commercial drivers spend many, many hours operating a vehicle most days in a given week. That raises the chances of sustaining damage to your windshield.

Ask your insurer about it if you’re unsure!

How does windshield replacement work?

If you do end up having to replace your windshield, don’t worry. It’s a common repair and a trusted professional can make it look like new.

You can expect those professionals to follow these steps to repair your windshield:

- Determining the extent of the damage, the risk of cracks spreading, and potential for obstruction of the driver’s view.

- Removing the old windshield and glass safely.

- Finding a new windshield meant for your vehicle’s specific make and model.

- Applying an industrial adhesive for the new frame.

- Installing the new windshield without any leaks, wind noise, or gaps.

- Cleaning the new windshield and area.

Once everything is dry, you’re ready to drive away!

How much does it cost to replace a windshield?

Does your car have those helpful features like adaptive cruise control, lane-keeping assistance, blind-spot warning, or surround-view camera?

Known as advanced driver assistance systems (ADAS), if your vehicle has these features then chances are high that you’ll be paying extra for your windshield replacement.

“Many ADAS features are dependent on an image-processing module (commonly referred to as a camera) mounted in the windshield. The camera must be calibrated when a windshield is replaced; if it’s not, the safety systems will not work properly. Repairs at aftermarket shops and dealerships start at $700 and can quickly climb into four figures, depending on the vehicle.”

– Doug Firby, The Globe and Mail, March 2019

While the average windshield replacement cost between $150 – $400 just a few years ago, owners of recently manufactured vehicles can expect to pay more in the ballpark of $700 – $1000 CAD. Keep in mind the type of vehicle you drive also affects the price (as with all repairs). That’s part of how car insurance works!

How long does it take to replace a windshield?

If you take your vehicle to a windshield repair specialist, the average replacement takes two hours: one hour to do the work, and one hour for the adhesive resin to dry. If you have ADAS features, it can also take an additional 45 minutes to calibrate the camera and system.

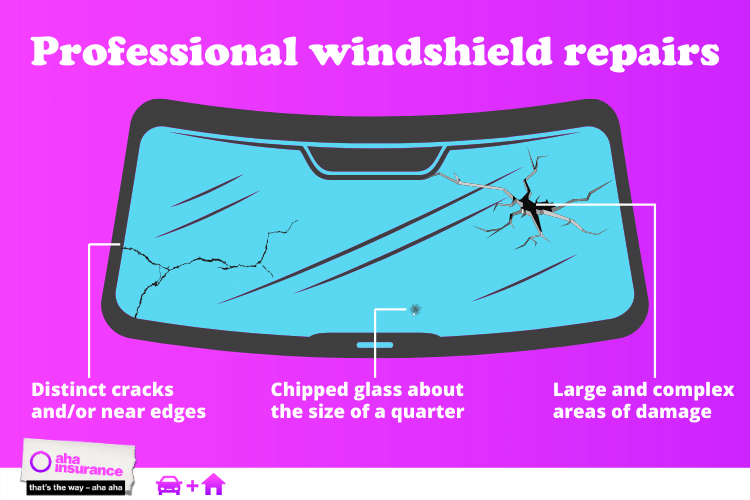

Does insurance cover badly cracked windshields?

If the chip has already turned into a crack, or if the initial damage was bad enough that a crack formed immediately, you will need to file a windshield insurance claim. It’ll be paid for independently of fault determination, similarly to how no-fault insurance works in Ontario. Windshield claims can be covered, but are often subject to your comprehensive deductible, so there might be a cost to you to have it replaced.

If you’re part of the aha insurance family, then you can file your claim right here.

How does fixing a windshield crack or chip work?

If the chip is smaller than a quarter or the crack is less than 3 inches long, it may only require a repair and not a full replacement. Here are the steps a trained professional (or experienced DIYer) would follow to repair it:

- Remove debris and clean the around the chip or crack.

- Apply resin to the chip or crack.

- Use a plunger or driver to extract any air.

- Cure the resin and cover with protective strips.

- Scrape away any excess to smooth the surface.

In about 30 minutes, your windshield will be fixed and as safe as ever! We recommend you seek out the help of a windshield professional to ensure repairs are done safely.

How much does it cost to repair a chip in my windshield?

A chip in the windshield is a minor repair for a professional and can cost between $50 – $150, depending on the severity and type of vehicle.

If you are an experienced mechanic, a DIY windshield repair kit could be purchased for as little as $25 – $50. Car insurance policies usually cover windshield repairs unless a driver has an active claims history.

How to Avoid Windshield Repair

Newer, lightweight glass is being used in vehicles these days, which is great for fuel mileage and windshield repair shops. However, glass damage is increasingly common—while some accidents can’t be avoided, there are ways you can reduce your risk of getting a crack in your windshield:

- Don’t drive directly behind large construction vehicles (i.e. a dump truck).

- Leave plenty of space following vehicles on gravel roads.

- Take the time to install windshield wipers correctly and replace them when they wear down.

- Store your vehicle carefully in extreme temperatures.

Being cautious is the best way to save your wallet some pain. A small chip may not seem like a big deal now, but studies have shown that 90% of chips will spread into larger cracks within three years. So better fixed than sorry!

How do chipped or cracked windshields affect my premium?

The good news is that a windshield insurance claim should have little to no effect on your premium. However, if your policy currently includes a claims-free credit, you may find that it disappears upon renewal. You can also ask your insurer about adding accident forgiveness coverage if you want air-tight protection, but that’s meant specifically for waiving higher rates on at-fault accidents.

Are there downsides in making windshield insurance claims?

Reporting a single windshield claim shouldn’t have any effect on your rates, assuming that your record doesn’t have many claims. However, if you have filed multiple comprehensive claims within the past few years, including windshield damage, your insurer may choose to increase your deductible.

If you have had a number of recent claims, we suggest you speak to your insurance advisor prior to filing the claim and ask their advice on whether you should proceed. You can call us too if you want a second opinion.

For most people, filing a windshield insurance claim is simple and easy. If you are able to have the damage repaired before it develops into a crack, you won’t even have to pay a deductible.