Life insurance

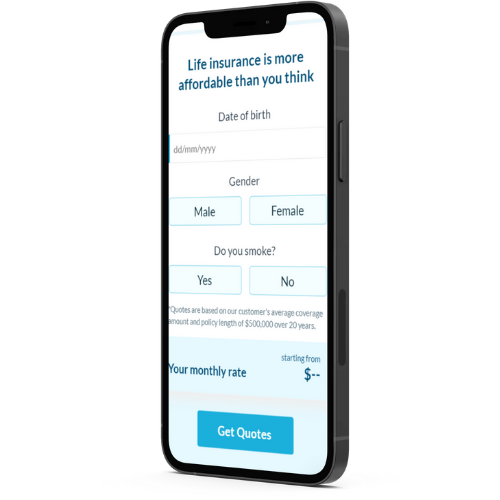

Easy, affordable, and done for you in minutes.

aha insurance has teamed up with PolicyMe to bring you the best term life insurance rates in Canada, and you don’t need to sit in a single awkward meeting.

What if life insurance were fast, easy, and affordable?

Oh wait…

15-minute coverage

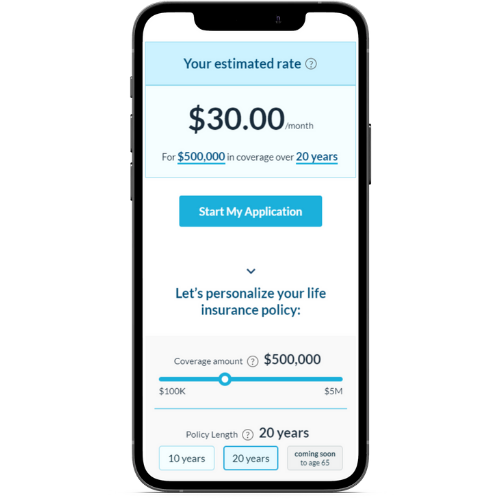

Our partner PolicyMe covers you in 15 minutes flat, including the medical questionnaire. Spoilers: the rates are super affordable, too!

10%-20% more affordable

PolicyMe offers term life insurance policies that are 10% – 20% cheaper than the other guys. Welcome to the digital world of insurance, baby!

Easy approval

When you remove all the jargon, hassles, and unnecessary steps, all that’s left are great rates and a quick approval. Everything’s easy to understand.

Your one-stop shop for online life insurance.

Life moves pretty fast these days. We don’t feel like spending hours to get a life insurance quote, and bet you don’t either.

Get the most competitive term life insurance on the Canadian market the easy way:

- No calls

- No paperwork

- No waiting

- No hassle

Whoever made insurance complicated needs to get a life (pun intended).

You won’t find any complicated industry jargon or legalese here.

We’ll always give it to you straight. That goes for everything—especially for life insurance coverage.

Q: When I get a quote I see "PolicyMe." What's up?

The folks at PolicyMe are our partners who specialize in Canadian life insurance. They believe in the same things that we do:

- Affordable insurance

- Fast (and accurate) quotes

- Easily managed policies

Starting a life insurance quote here will take you to PolicyMe’s website, where you can get an accurate quote in minutes.

It was an easy choice to partner up—we think you’re going to love them!

Q: I don't know anything about life insurance. What can I expect?

No worries there. You can buy several types of life insurance in Canada, but PolicyMe focuses on the one that really matters: term life insurance.

Term life insurance is lean, no-nonsense coverage that reimburses your beneficiaries in the event that you pass away when your policy is in force. Most people would buy coverage for themselves between the ages of 30-60 so that their partner, children, and/or other dependents are covered to pay for things like the mortgage and child education funds.

Q: Do I really need life insurance? How would I even know?

It depends on your stage in life. If you’re balancing a mortgage, a child, or an education fund while building life savings, then it’s a good idea to protect your dependents in the event of the unthinkable. That’s where life insurance comes in.

If you’re not sure, then do a quick life insurance checkup here to see if it’s right for this stage in your life.

Q: Can I still get coverage with COVID-19 happening?

Definitely. Most people haven’t seen any changes to their policies since the pandemic began, either.

If you’ve travelled to or from a pandemic hotspot (or plan to do so), then your application might be delayed until you’re sure you don’t have symptoms. Otherwise the process hasn’t really changed, which is great news if you want to get a quote.

Google Rating: 4.8

Hot Dang! Those are some beautiful words from beautiful people.

© 2021, PolicyMe Corp. (FSRA #36783M) offers policies issued by Canadian Premier Life Insurance Company (a federally regulated and wholly-owned subsidiary of Securian Financial). PolicyMe is licensed to operate in: British Columbia, Alberta, Saskatchewan, Manitoba, Ontario, New Brunswick, Prince Edward Island, Nova Scotia, Yukon Territories, Northwest Territories & Nunavut. Note: Securian Financial is the marketing name for Securian Financial Group, Inc. and its affiliates. Insurance products are issued by its affiliated insurance companies.