It’s late and you’ve had a long day—but it’s not over yet. Your insurance is renewing in a few weeks and you need to compare pricing and policies. Your son just got his G2 and your partner started a business last month, so your coverage needs are no longer so simple.

After looking through pages of insurance jargon and requesting several quotes, you’re no farther along than when you started. You could give up and take the quickest, easiest option, but we both know that could mean missing out on better rates or better coverage. Fortunately, there’s a trained professional who knows all the fine print and can do the leg work for you.

That’s where the insurance broker comes in.

What is an insurance broker?

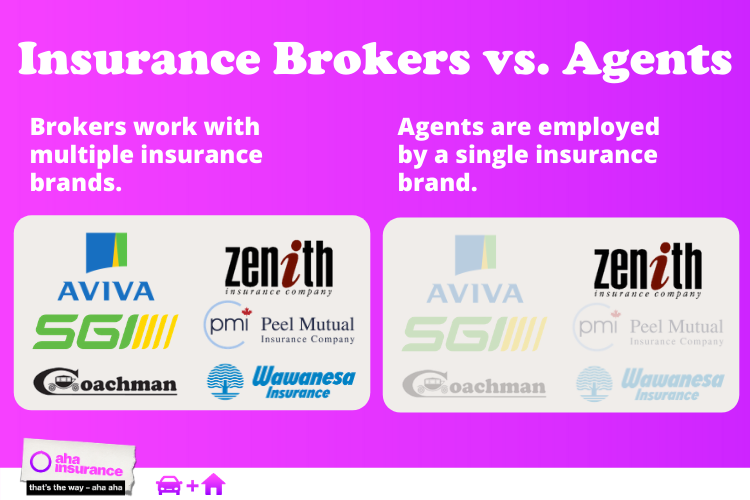

The first thing worth knowing is that brokers are not the same thing as insurance agents.

- Insurance agents work for a specific insurance company and can only sell policies from the company that employs them.

- Insurance brokers work for you and browse multiple insurance companies to find the best price and coverage for your situation.

Brokers know how insurance policies work and have access to more options than an agent. This lets them pick the best rates for the coverage you need from a wide variety of insurance companies.

Why do I need an insurance broker?

If you have an incredibly simple insurance policy and just need a basic car insurance renewal, it still pays to have an expert find the best coverage for the best rates.

Most of us fall into one of these common situations that benefit from a broker’s expertise:

- Own a business.

- Have a job that requires you driving your own vehicle or a company vehicle.

- Own multiple vehicles that have multiple drivers.

- Own multiple real estate properties.

- Act as a landlord for one of more tenants.

- Have a large estate with large investments and assets.

- Out of time or energy to compare a half-dozen policies on your own.

- Want personalized insurance advice based on your budget and coverage (not general insurance industry best practices).

- Want to learn the in-depth exclusions and limits of your policy.

Why work with an insurance broker?

What does an insurance broker actually do for you? There are four main reasons Canadians choose to work with a trusted broker over a direct agent or DIY comparison sites.

Insurance Brokers do the shopping for you

What is your time worth to you? Do you enjoy spending hours sifting through legalese and insurance terminology? It’s not how we’d spend our free time, either!

An insurance broker’s #1 job is to do the heavy lifting for you by finding a plan that fits your coverage needs and your budget. They understand the nuances of coverage and add-ons (often called “riders”) and can explain what each of them means, their limitations, and what would work best for your situation.

Using an Insurance Broker doesn’t cost extra money

Brokers typically operate on commission. The insurance company pays the broker for the sale and you get a competitive rate—everybody wins. The broker’s access to many different insurance companies means that they aren’t tied to any of them in particular, letting them chase the lowest rate on your behalf.

In Ontario, brokers are also licensed by the registered Insurance Brokers of Ontario (RIBO). That means they must abide by the Code of Ethics and disclose their commission rate or fees up-front. There are no surprises here.

Insurance Brokers have extensive claims experience

Brokers aren’t just useful for policy shopping. They have years of experience negotiating with companies and filing claims. They’ve been around the block hundreds of times and can walk you through insurance processes to get the best outcome.

One particular benefit here is offering claims counselling. If you are thinking about making an insurance claim but want to get a second opinion, then a broker can review your situation and offer advice before you ever speak to the insurance company that underwrites your policy.

New partners mean competitive rates

Brokers want your business and they know that customers appreciate getting the best rate possible. That’s why brokerages add a wide variety of partners to their rosters. Working with more insurance companies allows them to find more competitive rates for their own customers.

Questions to ask your insurance broker

You’ll want to make sure that the broker you work with has the right credentials and expertise to handle your situation (namely being licensed by RIBO), plus these other factors about how to choose a broker.

Here are several questions you should ask your about their experience and your policy before signing anything:

- What are your qualifications?

- Do you operate on commission or a fixed fee?

- Who is my insurance carrier?

- How long is my term?

- What additional records do I need to provide? (i.e. Driving Record for Good Driver Discount)

- What are the policy exclusions?

- Will you reach out when it’s time to renew?

- How does your claims process work?

Not every insurer has the best rate for you, but one of them does—and that’s why we’ve partnered with so many. Learn more about our team of insurance brokers today.