Third-party liability insurance has many names, which can make it difficult to understand and what it actually covers on your car insurance policy.

That’s why we’re here.

Legal liability coverage, auto liability insurance, third-party liability—whatever the term, it’s referring to an insurance policy that protects you against the financial repercussions of being sued for physical injury or damage to someone else’s property. The classic example is a car accident in which you harm another driver or passenger in the other vehicle and are sued for catastrophic damages, which isn’t fun for anyone.

Having third-party liability insurance for your car isn’t just a good idea. It’s actually part of Ontario’s mandatory car insurance. Why do drivers need to have it? Because car accidents can happen to the best of us on the road. It would be tough to face financial struggles—even bankruptcy—because of a simple mistake behind the wheel.

“Third-party liability claims payouts accounted for 46.6% of all direct claims incurred.”

2019 Facts of the Property and Casualty Insurance Industry in Canada, Insurance Bureau of Canada

Don’t struggle to pay your legal fees and lawsuit settlements (or break the law). Make sure you’re protected against what you can’t predict! It’s a legal requirement to drive, anyway, so you have to.

What is third-party liability insurance?

We already mentioned that third-party liability insurance coverage provides you with the finances needed to pay other parties that sue you for causing an accident. The coverage is specifically meant for the insured driver and/or owner of the vehicle. It’s used specifically if the motor vehicle injures or kills someone, or damages someone’s property through the fault of the driver.

It’s one of the 5 parts of an auto insurance policy, working alongside these other components:

- statutory accident benefits (in Ontario)

- direct compensation for property damage

- uninsured driver coverage

- optional coverage options

There’s also personal liability insurance for your home, which would fall under your home insurance policy and doesn’t apply to what we’re talking about here. Try not to confuse the two!

What does third-party liability insurance cover?

While lawsuits are not as common in Canada as they are in the United States, they do happen. If involved in a car accident you could potentially be sued by:

- a pedestrian

- a cyclist

- a motorcyclist

- the driver of the other vehicle

- the passengers in the other vehicle

- passengers within your own vehicle

- passengers and drivers in a multi-vehicle accident

“In 2018, Canadian private P&C insurers paid out $18.2 billion in direct claims incurred to policyholders for all types of auto insurance coverage: third-party liability, accident benefits, collision and comprehensive, and other coverages.”

2019 Facts of the Property and Casualty Insurance Industry in Canada, Insurance Bureau of Canada

There are many costs associated with being sued that go well beyond lawyer’s fees. Some of these expenses can include:

- settlement in lawsuits for pain and suffering, or economic loss

- medical expenses

- funeral expenses

- disability income

- death benefits

- other related expenses

Without your third-party liability insurance, you could potentially end up paying millions of dollars out of your own pocket and claiming bankruptcy. For example, if you were driving your mom’s car but still listed as an occasional driver on her policy, then the liability portion of the policy should have you covered in the event of an accident. Imagine how disastrous that could be without the coverage, though.

An Unforgettable Lesson

In 2007, one of the highest damage awards in Canada occurred in a third-party liability lawsuit that is still remembered today for its tragic outcome. Here are the highlights:

- Three friends were driving to a cottage in Northern Ontario to attend a party.

- When attempting to pass on a curve, the driver attempted to avoid a collision and lost control of the vehicle.

- Both passengers were not wearing seat belts and thrown from the vehicle.

- The driver was speeding and found to have a blood-alcohol level greatly in excess of the legal limit.

- One passenger suffered a brain and spinal injury, requiring 24-hour care, and was awarded $11.3 million.

Many lives were permanently altered that evening, with over $19 million dollars in damages awarded at the end of the case because of one fateful accident. It’s also worth mentioning that most car insurance policies don’t contain liability limits that high ($1 million and $2 million limits are the most common), so they likely wouldn’t have been able to cover the entire cost of the awarded funds. That’s why third-party liability insurance is so important in understanding how car insurance works.

How much third-party liability insurance coverage do I need?

Third-party liability insurance is mandatory across Canada, but each province or territory has its own specific minimum and regulations (listed below). As a general rule, it’s typically recommended to have at least $1,000,000 in third-party liability coverage. Most insurers insist on that number as a minimum amount in practice, too.

But how do you know if the required minimum is enough? You should consider the following circumstances to help you decide if you need to increase your coverage to suit your needs:

- Do you travel a lot with your vehicle?

- Do you use your vehicle for work?

- Do you live in a densely populated area where the chance of getting into a car accident is higher?

- Do you live in a geographic area with extreme weather conditions that increase the number of accidents?

- Are you often driving with passengers?

- Do you have children who are often in the vehicle?

- Do you commute for a living? The 401 saw 53,279 accidents from 2011 – 2015.

- Do you do a lot of highway driving?

- How much could you afford to cover on your own if the costs exceeded your coverage?

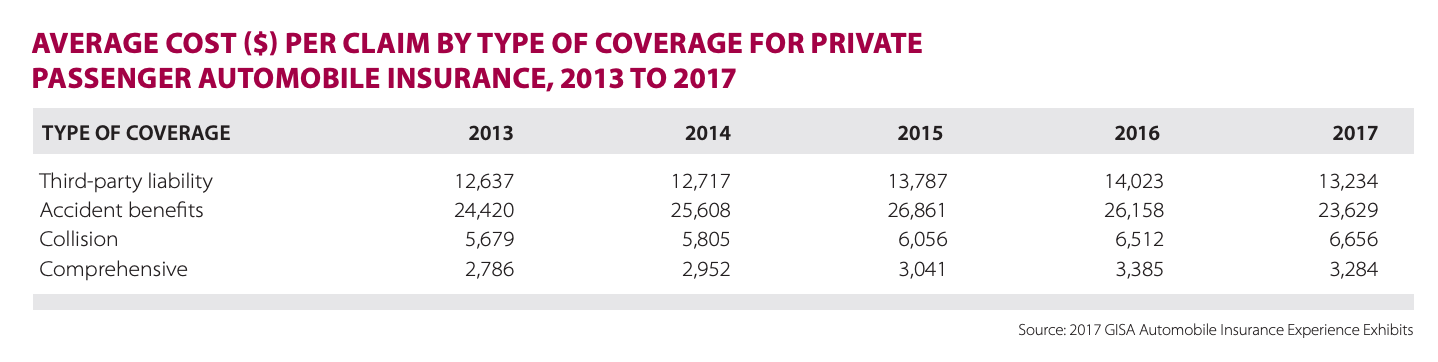

The average cost per third-party liability claim in Canada was $13,234 in 2017. Could you afford to pay that—or even more?

Mandatory Minimum Third-Party Liability Coverage Across Canada

Each province has its own minimum for third-party auto liability insurance, so we’ve outlined them all right here for you.

Ontario

$200,000 available for any one accident; however, if a claim involving both bodily injury and property damage reaches this figure, payment for property damage will be capped at $10,000. Most insurers won’t offer coverage limits any lower than $1,000,000 in practice, though.

British Columbia

$200,000 available for any one accident; however, if a claim involving both bodily injury and property damage reaches this figure, payment for property damage will be capped at $20,000.

Alberta

$200,000 available for any one accident; however, if a claim involving both bodily injury and property damage reaches this figure, payment for property damage will be capped at $10,000.

Saskatchewan

$200,000 available for any one accident; however, if a claim involving both bodily injury and property damage reaches this figure, payment for property damage will be capped at $10,000.

Manitoba

$200,000 available for any one accident; however, if a claim involving both bodily injury and property damage reaches this figure, payment for property damage will be capped at $20,000.

Quebec

$50,000 is available for any one accident; liability limits relate to property damage claims within Quebec and to personal injury and property damage claims outside Quebec.

New Brunswick

$200,000 available for any one accident; however, if a claim involving both bodily injury and property damage reaches this figure, payment for property damage will be capped at $20,000.

Nova Scotia

$500,000 is available for any one accident.

Prince Edward Island

$200,000 available for any one accident; however, if a claim involving both bodily injury and property damage reaches this figure, payment for property damage will be capped at $10,000.

Newfoundland and Labrador

$200,000 available for any one accident; however, if a claim involving both bodily injury and property damage reaches this figure, payment for property damage will be capped at $20,000.

Yukon

$200,000 available for any one accident; however, if a claim involving both bodily injury and property damage reaches this figure, payment for property damage will be capped at $10,000.

Northwest Territories and Nunavut

$200,000 available for any one accident; however, if a claim involving both bodily injury and property damage reaches this figure, payment for property damage will be capped at $10,000.

Want to see what your third-party liability coverage looks like? Get a 3-minute quote right here. It’s accurate and guaranteed for 60 days!