There are some words that every small business owner dreads to hear: “there was a fire in the kitchen” and “the showroom is flooded” come to mind – and that’s why business interruption insurance exists.

Business owners are busy people with many tasks on their to-do list, but sometimes they forget to protect themselves against the unexpected.

“Our research suggests that one in five small businesses would shut down within 30 days if sales stopped yet only 23% have business interruption insurance. This means any hiccup in cash flow can put the business at risk. In general, business owners aren’t properly insuring themselves against risks to revenue.”

– Brad Plothow, Vice President of Brand & Communications, Womply

What is business interruption insurance?

Business interruption insurance is a type of commercial property insurance that protects against income loss as a direct result of loss, damage, or destruction to insured property. That could be a fire started in a restaurant oven, or a windstorm that destroyed a hotel roof.

Most insurance providers offer a form of business interruption insurance that covers your revenue until your business returns to normal levels—matching revenue levels before whatever unforeseen event caused the sudden loss in the first place.

How much does it cost?

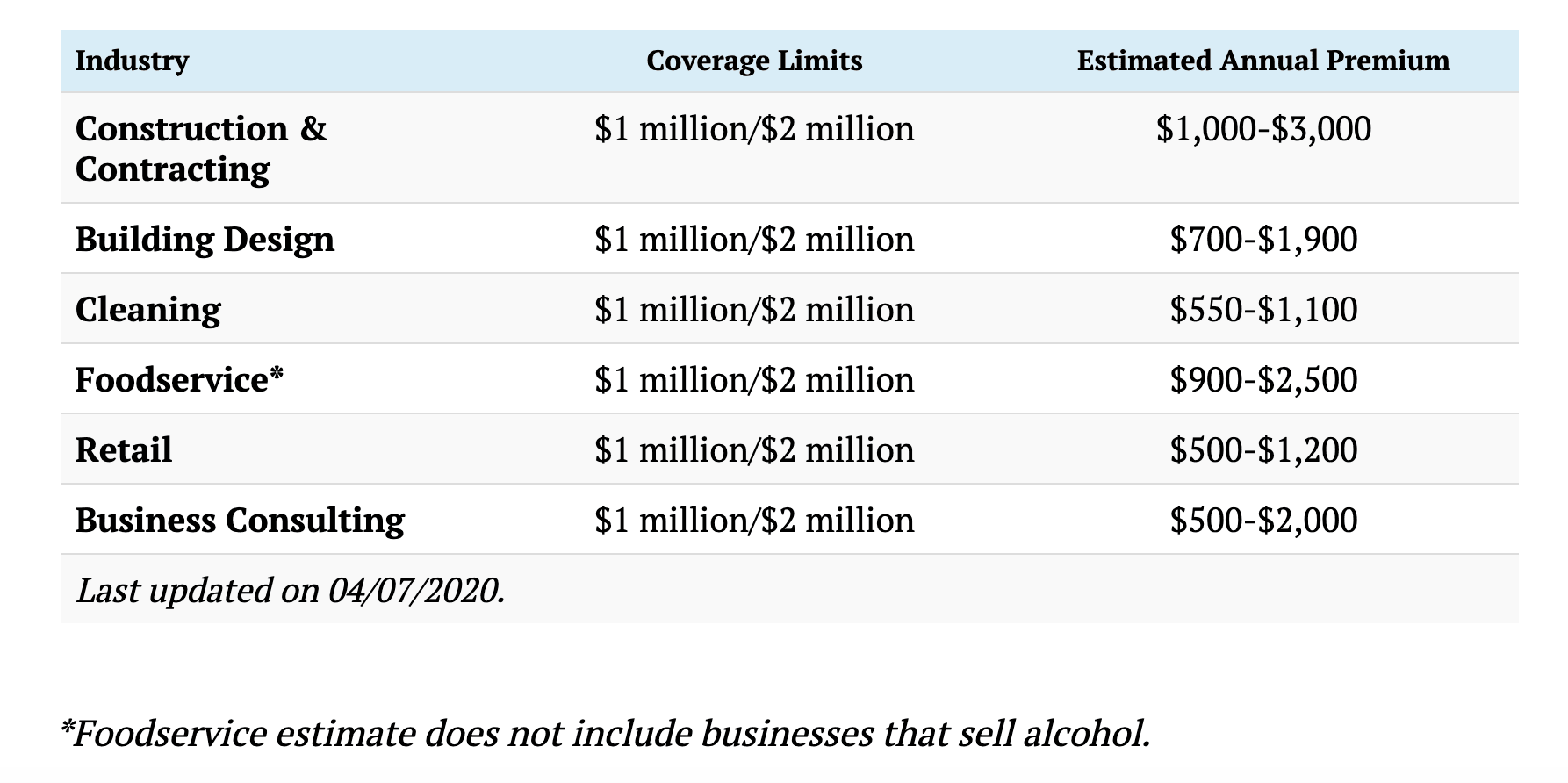

You’ll usually find business interruption insurance sold as part of a business owner’s policy (BOP), which can cost anywhere between $500 to $3,000 per year. These things factor into the cost per year:

- Industry

- Company size

- Coverage limits

- Location

Location can trip people up more than the other factors, but here’s why it matters: some areas experience more instances of severe weather, property damage, and crime than others. That’s why two similar businesses can see different rates, even if they’re in the same niche, generating similar revenue, and are about the same size. Flood planes and regions that see severe wind storms can raise the cost of coverage, in particular.

Use these average coverage limits and annual premiums across six highly-affected industries to get a general sense of what it might cost:

What’s covered by business interruption insurance?

The most typical business interruption insurance claims come from perils like this:

- Vandalism (if the damage prevents you from operating normally)

- Burst pipes

- Windstorms

- Fires

Natural disasters like floods and earthquakes—which aren’t usually covered by a commercial property insurance policy—likely won’t be covered by business interruption insurance, either, but you can certainly add coverage for those things to your policy. They’re called endorsements, and they’re useful.

Policies can vary a lot between what they cover and what they don’t. You should know whether the policy you are buying is named perils or all risk. What’s the difference? “all risk” protects against any peril that isn’t specifically mentioned in the exclusions, whereas “named perils” only covers against the list of named risks in the policy.

Once your claim has been accepted, you can expect a standard business interruption policy to cover expenses like:

- Lost Profits

- Payroll

- Loan payments

- Rent or mortgage payments

- Repairs

- Construction for rebuilding

- Rental equipment

- Temporary relocation costs

- Taxes

- Training and employee on-boarding

Make sure you keep your business interruption insurance up to date with your company’s earnings. Some policies have an income cap, and your business may be making more money a few years into the future than it is today.

What is “actual loss sustained,” or ALS?

Actual Loss Sustained (ALS) is just insurance jargon for the dollar amount of loss sustained from the suspension of your business operations—essentially the amount the insurer is would pay out for a claim. Be aware that there is often a limit to this amount, so be sure to read the fine print.

Extra expenses can be submitted in addition to the basic ALS, but they will only be covered within reason. It is the business owner’s responsibility to minimize loss during the closure. To be considered, extra expenses must be necessary expenses that they would not have been subject to otherwise.

What are extensions of coverage?

If you have a commercial property insurance policy, then it may have an “extensions of coverage” section. This differs from business interruption insurance slightly in what it covers against:

- Service interruption: Coverage for direct physical loss, damage, or destruction to electrical, steam, gas, water, sewer, telephone, or any other utility or service including transmission lines and related plants, substations, and equipment of suppliers.

- Contingent business interruption: Coverage for loss, damage, or destruction of property owned by others.

- Leader property: Coverage for direct physical loss, damage, or destruction of the type insured by the insured’s property policy to property not owned or operated by the insured, located within the stated distance to insured’s property or business, and which attracts business to the insured. (For example:you own a restaurant next to a popular amusement park and that park closes temporarily due to windstorm damage.)

- Interruption by civil or military authority: Coverage is provided to the insured for the actual loss sustained by the insured during the length of time when access to such described premises is specifically prohibited by order of civil authority as a direct result of damage.

How long does business interruption insurance last?

The length of time that insurers are liable is called the “Period of Restoration” or the “Indemnity Period.” This typically starts when the physical loss or damage occurs (i.e. the day that the interruption happens) and ends when the repairing/rebuilding/replacement has been completed (i.e. the day the restaurant re-opens).

The one big caveat is that this has to be done within a reasonable time-frame. You cannot put off repairs for two months because you are taking a vacation, for example.

One important thing to note: if your policy expires before the repairs are complete, you are still entitled to coverage. As long as the incident occurred while the policy is active, you don’t have to worry. Double-check your policy for any limits to the coverage amount or restoration period, but you can go to sleep at night knowing you won’t be left out in the cold.

How much business interruption insurance do I need?

Businesses that have physical locations and assets (restaurants, retail stores, salons, manufacturing, recreational facilities, etc.) should have business interruption insurance, since those businesses hinge on the location’s ability to remain open.

Follow these steps to determine how much you should secure:

- Discuss coverage options with your aha insurance expert.

- Review your financial security with your accountant (expenses, cashflow, reserves, etc.)

- Calculate different scenarios and the cost to have operations suspended (i.e. a restaurant on the riverbank is flooded in the spring and must close for one month, the stove/oven in the restaurant breaks and they close for one week, there’s a fire in the kitchen and dining room and they close for four months, etc.)

- Based on the risk of your location, business, and financial situation, select which coverage option is best for your business:

- All Risk

- Named Perils

- Limited

- Extended

- Extra Expenses

- Speak to other business owners within the same industry about past experiences and expenses.

- Calculate how much you can afford to pay in policy premiums to determine your policy limits (such as limits on total coverage amount and payments per month.)

- Secure your business interruption insurance policy.

Those are the ins and outs of business interruption insurance. Get in touch to get a great rate!