Generation X feeling the retirement squeeze

By Jonathan Chevreau. First published at The Findependence Hub.

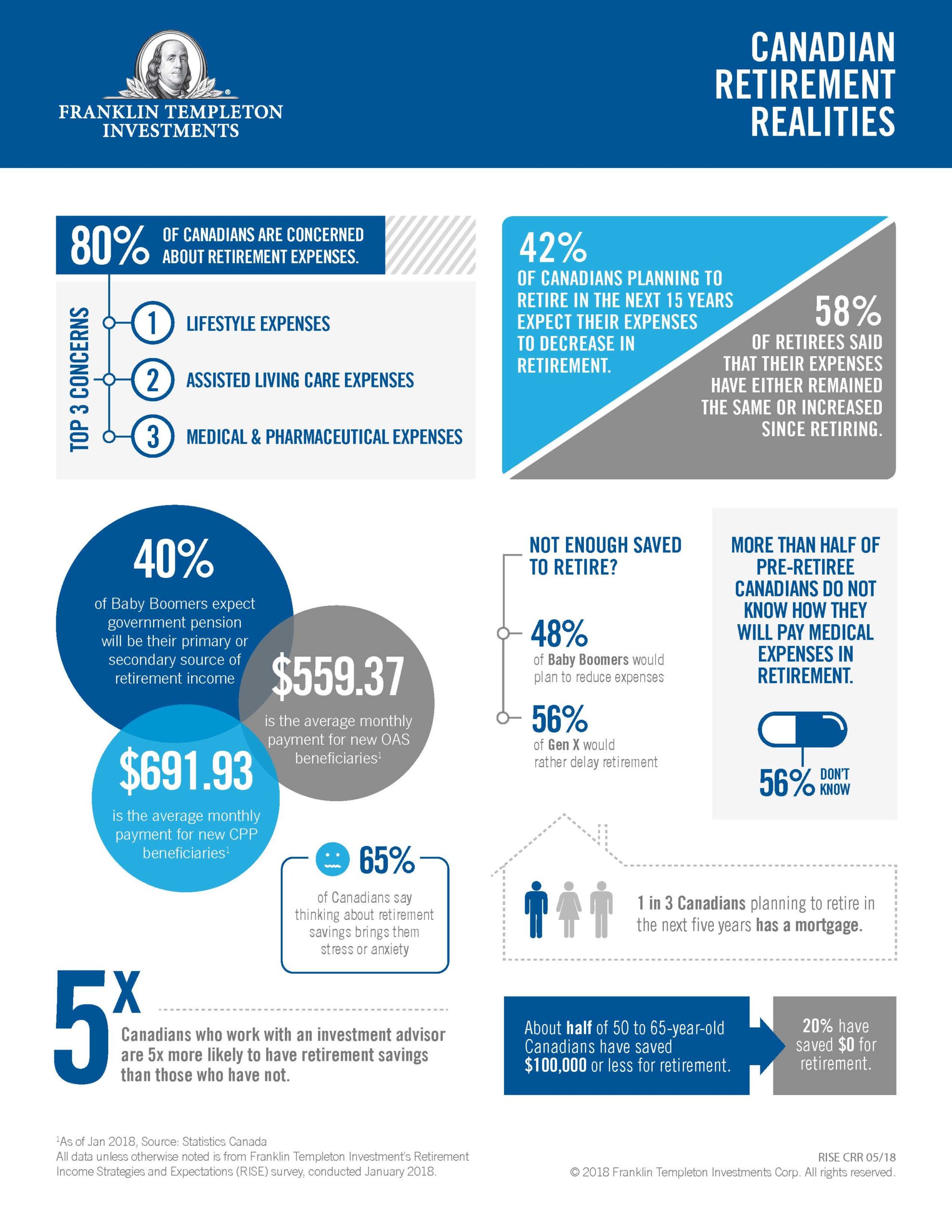

Generation X, and to a lesser extent the Millennials, are already starting to feel the retirement squeeze, according to a Franklin Templeton-sponsored survey released Thursday.

Details are in my column in Friday’s Financial Post, which you can retrieve by clicking on the highlighted headline here: Generation X is ‘stretched beyond their financial limits’ and struggling to save for retirement.

The challenges should be familiar to members of any generation (four are mentioned in the survey): it’s never easy saving money when you’re starting out in life with low wages and high expenses. But Franklin Templeton cautions against the rationalization embraced by younger investors that they simply can choose to keep on working if they haven’t accumulated enough assets to generate adequate income in retirement.

That may not always be an option, since ill health or corporate downsizing (to mention just two) may prevent this. You can find full details about the fifth annual edition of Franklin Templeton Investments Canada’s 2018 Retirement Income Strategies and Expectations (RISE) survey here.

Stressed GenX resigned to retiring later than hoped

More than half of Gen Xers (aged 37 to 52) are resigned to retiring later than they would want (56% in Canada, 59% in the US). While the online survey included Canadians and Americans across four generations, “this year we felt in particular that Gen X and the stress of preparing for Retirement was the predominant thing coming out of the research,” said Matthew Williams, a Franklin Templeton senior vice president, in an interview.

Millennials (currently aged 18 to 36) also fret about lack of retirement saving but they have a bit more time to get their acts together and start saving. In fact, since 28% of Millennials are still living with their parents or their spouse’s parents, you could argue they’re not even out of the starting gate for financial independence. On the other hand, living at home should give them a leg up in paying down debt (whether student loans or credit cards) since their expenses should be (presumably) minimal. And temporary though the arrangement may be, it’s also an opportunity to sock money saved on rent into a Tax-free Savings Account (TFSA), the better to come up with a down payment for a first home.

And as I say in my financial novel, Findependence Day, a paid-for home is the foundation of Financial Independence. The trick is to get into the automatic saving habit as early as you can. Life is always expensive, which is why young people have to practice what the characters in the book call “guerrilla frugality.”

Yes, the Boomers had some advantages: homes were relatively inexpensive when we were starting out, even though interest rates were sky-high, so we were motivated to pay them down as soon as possible. They can be sold tax-free at today’s much higher prices but even then you have to live somewhere: downsizing to a condo perhaps or to the country.

Some but certainly not all Boomers benefited from Defined Benefit employer pensions; in fact, the survey finds that already-retired boomers are almost twice as likely to rely on employer pensions (39% of them do), than non-retired boomers (21%).

About Jonathan Chevreau

Jonathan Chevreau has been writing about personal finance since 1996 for the Financial Post, after starting his journalism career as a technology reporter for the Globe & Mail in the early 1980s. He has authored nine books on mutual funds, stock markets and investing. His latest book is a financial novel called Findependence Day. It’s a financial love story aimed at the children of wealthy boomers: young people just embarking on careers, family formation and investing.

Seriously, what else can you do in 3 minutes?

Boil half an egg?

You might like these posts, too.

Free yourself of student loan debt with these relief options

By LoanConnect According to the Canadian Federation of Students, the average university graduate carries approximately $27,000 in student loan debt. Today, nearly 2 million graduates have student loans that total more than $20 billion. Though many individuals go into...

The Types of Insurance Everybody Needs

By PolicyMe We get it, insurance covers a lot of different things: health, car, home, life, disability… the list goes on. It can be overwhelming to figure out what you need and when to get it. There are so many types of insurance and more providers to give you...

Haunting Home Disclosures

By PropertyGuys.com We’ve all heard the term “if these walls could talk,” and let’s face it, homes have a history—some more than others. While most of us have seen scary movies and heard home horror stories centred around unsuspecting buyers led to their doom, this...

How are we doing?

How are we doing?